Higher Returns, Secured Investments

Invest in India’s Largest Farmers Organisation

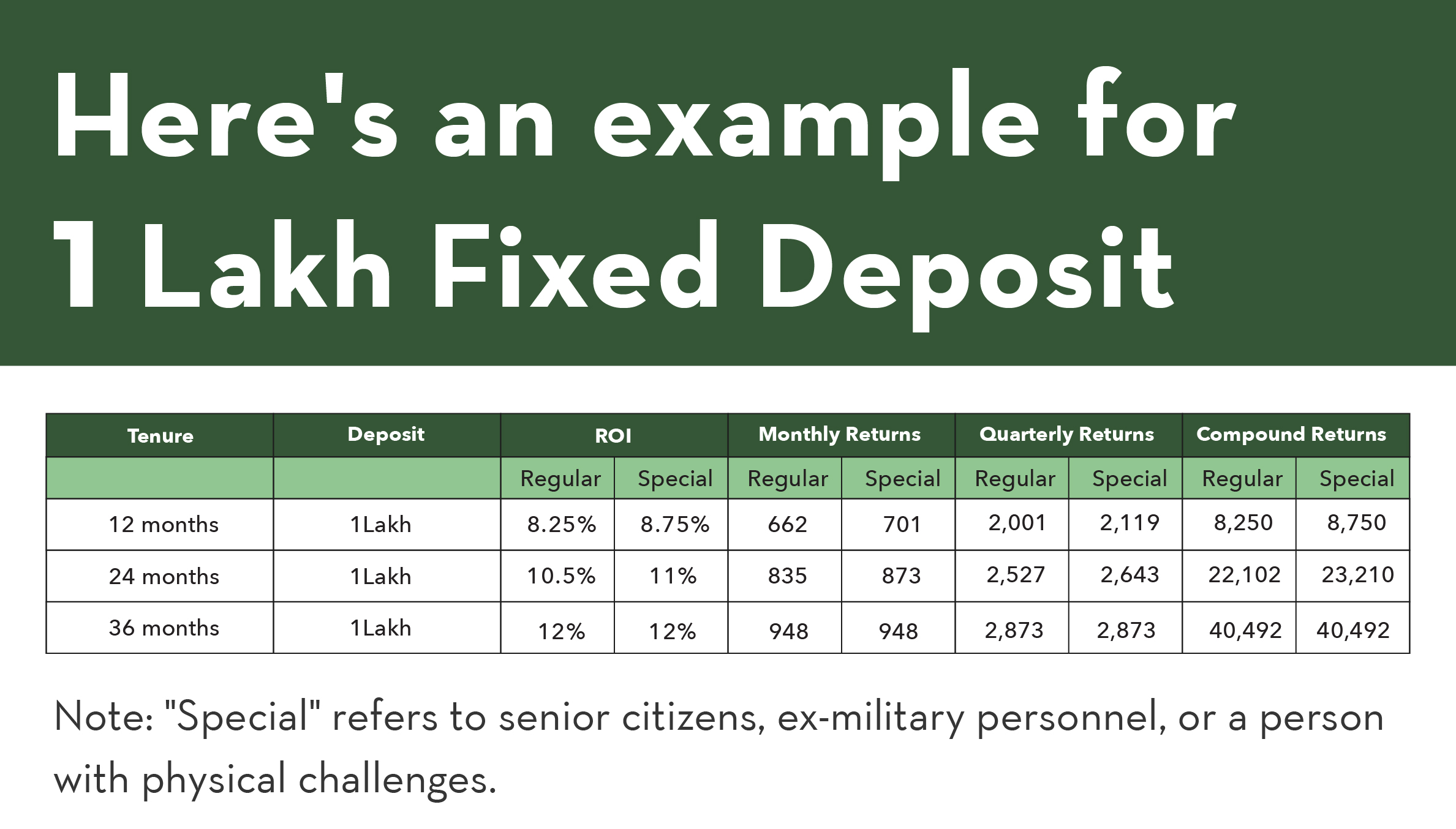

Your Monthly interest will be ₹9.48

| Customer Type | Normal | |||||

| Tenure | Monthly | Quarterly | Yearly | On Maturity | On Maturity with Principal | |

Note:

To apply for fixed deposit, you must be a member and shareholder of the organization. This requires purchasing 1 share for ₹1,000 and a lifetime membership for ₹500. So, additional ₹1,500 must be paid during the deposit payment.

Grow your savings and nurture the future of agriculture with our Fixed Deposits. Your investment supports farmers and rural development, all while earning you attractive returns. Secure your finances and be part of positive change. Invest in KALPASAMRUDDHI Fixed Deposits and watch your savings flourish in the agriculture sector.

Why Choose Us for Fixed Deposits?

Competitive Interest Rates

Flexible Tenure

Flexible Pay-out Options

Min & Max Deposit

of 10 Cr.

Extra Returns

Seamless Interest Transfer

For Fixed Deposit related queries please contact +918105487763

Who can invest in a Fixed Deposit with us?

Individual

Joint Ownership

Guardian for a Minor

NRI’s

How To Apply for Fixed Deposit?

- Apply: Fill out the Fixed Deposit Form and upload your KYC Documents.

- Choose Pay-out Options: Select your preferred interest returns pay-out frequency: monthly, Yearly, On-maturity, compound interest will be calculated for Fixed Deposits.

- Deposit Funds: Deposit your desired amount into the Company account.

- FD Account Activation: Your FD account will be activated once the funds are successfully deposited.

- Receive Deposit & Share Certificate: After you have made the payment for your fixed deposits, you will receive the deposit certificate and share certificate at your registered address by Registered post.

Apply Here!

FAQS

1. Is TDS applicable on Fixed Deposit interest?

Yes, Tax Deducted at Source (TDS) is applicable on the interest earned from Fixed Deposits as per the prevailing tax laws. TDS is currently deducted at a rate of 10% of the total interest earned on FDs for a financial year.

2. Do I need to become a shareholder of the company in order to open a Fixed Deposit?

Yes, you have to become a shareholder of the company to open a fixed deposit.

3. How to use the Fixed Deposit Calculator?

You can use the FD Calculator to calculate interest and maturity amount on the Fixed Deposit as follows:

• Enter the amount of Fixed Deposit

• You can select the Customer Type i.e., Below 60, Senior Citizen, Ex-Military & Physically Challenged.

• Select Tenure for your fixed deposit.

• The applicable interest rate, interest amount, and maturity amount will be displayed.

4. How can I make a payment for a fixed deposit?

You can make payments for a fixed deposit by transferring funds to the company’s bank account through NEFT or RTGS.

5. How can I receive a receipt for my payment?

After a successful payment, the receipt will be sent to your registered address through Registered Post.

6. Can I withdraw funds before the completion of the tenure?

There is no premature withdrawal facility available before the tenure’s expiry. However, in the unfortunate event of the depositor’s death, premature withdrawal is possible. In the case of a joint fixed deposit with a survivorship clause, the company will discharge the fixed deposit proceeds prematurely to the survivors upon their request, in the event of the death of one or more joint depositors.